Anúncios

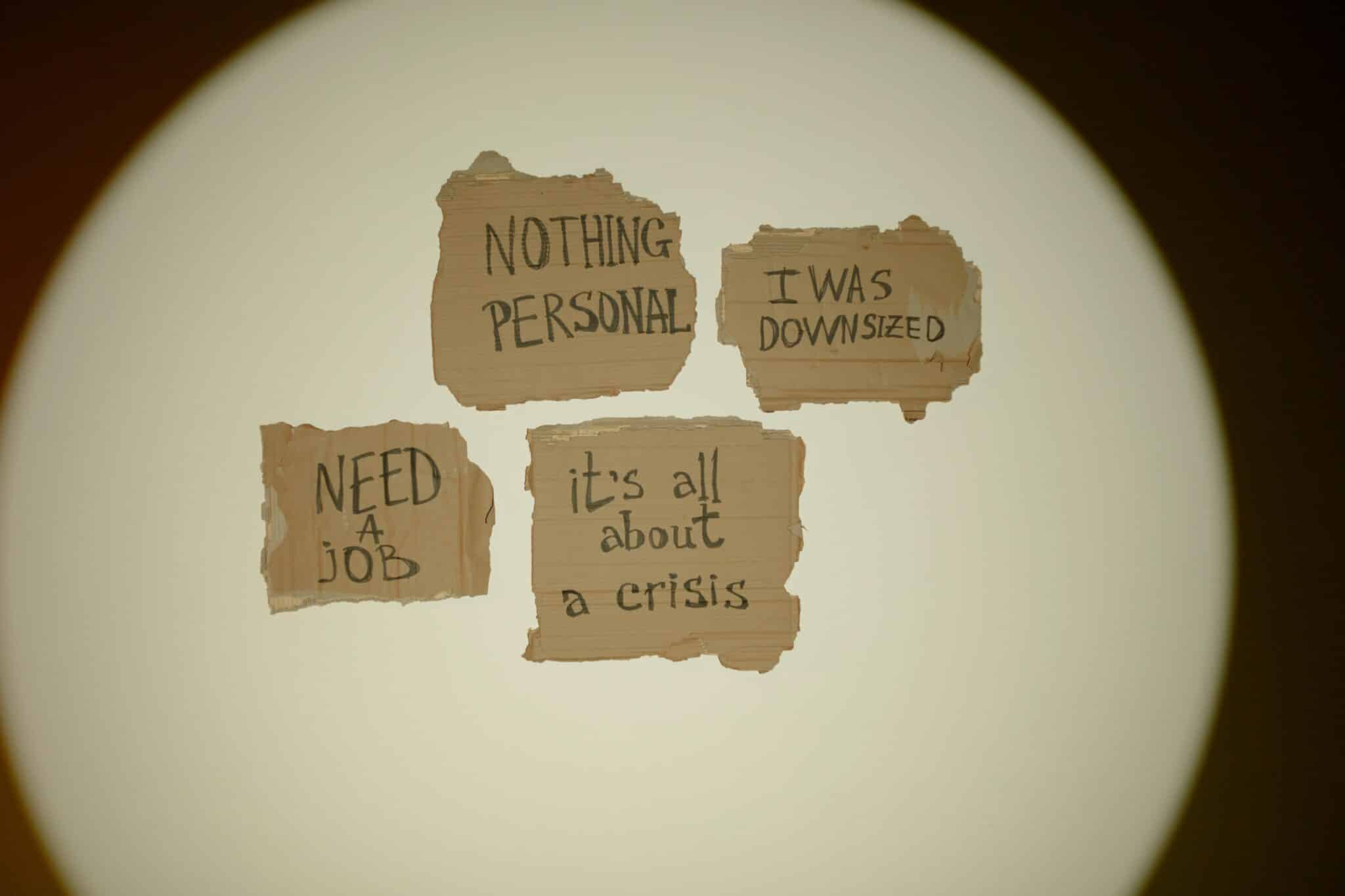

In today’s volatile economic landscape, understanding human behavior becomes as crucial as analyzing charts and fundamentals when navigating investment decisions and market uncertainties.

🧠 Understanding Behavioral Economics in Market Context

Behavioral economics has emerged as a transformative lens through which we can understand financial markets and investor decisions. Unlike traditional economic theory, which assumes rational actors making logical choices, behavioral economics acknowledges that humans are complex, emotional beings whose decisions are influenced by cognitive biases, social pressures, and psychological factors.

Anúncios

During periods of market turbulence, these behavioral patterns become even more pronounced. Investors panic, herd mentality takes over, and decisions that seem irrational in hindsight feel completely justified in the moment. The COVID-19 pandemic market crash of 2020, followed by unprecedented recovery, illustrated perfectly how behavioral factors can amplify market movements beyond what fundamentals alone would suggest.

The field gained mainstream recognition when Daniel Kahneman won the Nobel Prize in Economics in 2002 for integrating insights from psychological research into economic science. His work, along with Amos Tversky’s, revealed systematic patterns in how people make decisions under uncertainty—patterns that deviate significantly from the rational actor model.

Anúncios

The Psychology Behind Market Movements

Markets are essentially aggregations of human decisions, and understanding the psychological underpinnings of these decisions provides investors with a significant advantage. Fear and greed, the two primary emotions driving market behavior, create predictable patterns that savvy investors can recognize and potentially exploit.

During uncertain times, loss aversion becomes particularly powerful. Research shows that the pain of losing money is approximately twice as intense as the pleasure of gaining the same amount. This asymmetry explains why market downturns often occur more rapidly than upswings—panic selling driven by fear of losses creates momentum that fundamentals alone cannot explain.

📊 Key Behavioral Biases That Shape Market Decisions

Several cognitive biases consistently influence investor behavior, especially during turbulent periods. Recognizing these biases in yourself and others can be the difference between capitalizing on opportunities and falling victim to market hysteria.

Confirmation Bias and Market Narratives

Confirmation bias leads investors to seek information that supports their existing beliefs while dismissing contradictory evidence. During market uncertainty, this bias becomes particularly dangerous. If you believe a market crash is imminent, you’ll find endless articles, charts, and opinions supporting this view, while ignoring equally valid signals suggesting resilience or recovery.

This bias explains why market bubbles persist longer than rational analysis suggests they should. Believers in a particular investment thesis continue finding evidence supporting their position, reinforcing group consensus and delaying the inevitable correction. The dot-com bubble and the 2008 housing crisis both demonstrated how confirmation bias can blind entire industries to mounting risks.

Recency Bias and Short-Term Thinking

Recency bias causes investors to overweight recent events when making decisions about the future. After experiencing a market crash, investors become excessively pessimistic, assuming similar crashes are imminent. Conversely, during bull markets, recent gains create unrealistic expectations of continued growth.

This bias undermines long-term investment strategies. Investors who sold everything during the 2020 pandemic panic missed the subsequent rapid recovery. Those who maintained discipline and perspective, understanding that recent volatility doesn’t define future trajectories, were rewarded for their behavioral awareness.

Herd Mentality and Social Proof

Humans are social creatures, and our decisions are profoundly influenced by what others around us are doing. In financial markets, this manifests as herd mentality—the tendency to follow the crowd regardless of personal analysis or conviction.

During turbulent times, herd mentality amplifies volatility. When everyone is selling, the impulse to join them becomes overwhelming, even when fundamentals suggest it’s precisely the wrong time to sell. Similarly, FOMO (fear of missing out) during market rallies drives investors to buy at inflated prices simply because everyone else is doing so.

💡 Applying Behavioral Economics to Investment Strategy

Understanding behavioral economics isn’t merely academic—it has profound practical applications for investors navigating uncertain markets. By recognizing these patterns in yourself and others, you can develop strategies that capitalize on behavioral inefficiencies while protecting yourself from your own cognitive biases.

Creating Decision-Making Frameworks

The first step in applying behavioral economics is establishing clear decision-making frameworks before turbulence strikes. When markets are calm, outline your investment thesis, risk tolerance, and criteria for buying or selling. Document these decisions explicitly, creating a reference point for times when emotions run high.

These frameworks serve as behavioral guardrails. When panic or euphoria tempts you to deviate from your strategy, your documented framework provides rational counterbalance. This approach transforms investing from an emotional reaction to a disciplined process, significantly improving long-term outcomes.

Systematic Rebalancing and Dollar-Cost Averaging

Systematic approaches remove emotional decision-making from the investment process. Dollar-cost averaging—investing fixed amounts at regular intervals regardless of market conditions—eliminates the need to time the market, a task at which even professionals consistently fail.

Regular portfolio rebalancing similarly imposes discipline. By automatically selling assets that have appreciated and buying those that have declined, rebalancing forces you to “buy low and sell high” even when your emotions scream to do the opposite. This mechanical approach leverages behavioral economics by designing systems that counteract your natural biases.

🎯 Contrarian Thinking in Volatile Markets

Some of the most successful investors in history—Warren Buffett, Howard Marks, and John Templeton—are famous contrarians who actively position themselves against prevailing market sentiment. This approach directly applies behavioral economics principles by recognizing that crowd behavior creates mispricings.

Identifying Opportunities in Market Pessimism

The famous Buffett maxim “be fearful when others are greedy and greedy when others are fearful” encapsulates contrarian behavioral strategy. When markets are gripped by panic and quality assets are indiscriminately sold off, behavioral-aware investors recognize opportunity rather than danger.

This doesn’t mean blindly buying during every downturn. Rather, it means having the psychological framework to evaluate opportunities rationally when others cannot. During the 2008 financial crisis, while most investors were paralyzed by fear, contrarians who maintained perspective and liquidity positioned themselves for extraordinary returns in the subsequent recovery.

Recognizing Market Euphoria as Warning Signal

Equally important is recognizing when markets have become irrationally exuberant. When taxi drivers are giving stock tips, when valuations reach historic extremes, and when leverage is at all-time highs, behavioral economics suggests caution regardless of how much money your neighbors are making.

The challenge is that going against the crowd during euphoria feels worse than during panic. Missing out on gains while others celebrate feels like failure, even when you’re protecting yourself from inevitable correction. Understanding this psychological dynamic helps investors maintain discipline during bubble periods.

📈 Behavioral Economics and Risk Management

Risk management becomes particularly crucial during uncertain times, and behavioral economics provides insights into why traditional risk models often fail precisely when they’re most needed.

Mental Accounting and Portfolio Construction

Mental accounting refers to the tendency to treat money differently depending on its source or intended use. Investors might be ultra-conservative with retirement savings while gambling recklessly with “found money” or recent gains, despite money being fungible.

Sophisticated investors can leverage mental accounting positively by creating separate portfolio buckets with different objectives and risk profiles. A short-term stability bucket provides psychological comfort during volatility, reducing the temptation to panic-sell long-term holdings. This approach acknowledges behavioral realities rather than assuming purely rational decision-making.

Loss Aversion and Position Sizing

Because losses hurt more than equivalent gains feel good, proper position sizing becomes critical. Taking positions so large that potential losses would be emotionally devastating virtually guarantees poor decision-making during volatility. You’ll sell at the worst possible time simply to end the psychological pain.

Behavioral-aware position sizing ensures no single investment can devastate your portfolio or your psychology. This approach trades maximum potential returns for psychological sustainability—a worthwhile trade because investors who can emotionally withstand volatility consistently outperform those with theoretically optimal but psychologically unbearable portfolios.

🔄 The Narrative Fallacy in Market Analysis

Humans are storytelling creatures. We constantly create narratives to explain events and predict futures, a tendency that profoundly affects market interpretation during uncertain times.

How Stories Drive Market Sentiment

Markets don’t move based purely on data—they move based on the stories investors tell about that data. The same economic report can be interpreted bullishly or bearishly depending on prevailing narrative. During uncertain times, competing narratives battle for dominance, and whichever story becomes consensus drives market direction regardless of objective truth.

The narrative fallacy causes investors to see patterns and causation where none exist. After markets move, we construct logical-sounding explanations for why they moved, creating false confidence in our ability to predict future movements. This illusion of understanding increases risk-taking precisely when caution would be appropriate.

Separating Signal from Noise

Behavioral economics teaches us that most market movements are noise rather than signal—random fluctuations without predictive value. However, our pattern-seeking brains insist on finding meaning in randomness, leading to overtrading and excessive confidence in spurious correlations.

Successful navigation of turbulent markets requires distinguishing genuine signals from noise. This means developing filters that separate meaningful information from the endless stream of market commentary, economic data, and price movements. Long-term investors might check portfolios quarterly rather than daily, dramatically reducing exposure to meaningless short-term noise.

🛡️ Building Behavioral Resilience for Market Turbulence

The ultimate application of behavioral economics isn’t just understanding biases intellectually—it’s building psychological resilience that allows you to act rationally when markets test your discipline.

Emotional Regulation Techniques

During market crises, emotional regulation becomes as important as financial analysis. Techniques like mindfulness, predetermined decision rules, and maintaining perspective through historical context help investors avoid panic-driven mistakes.

Creating physical and psychological distance from markets during high volatility can paradoxically improve decision quality. Constantly monitoring portfolios during crashes amplifies emotional reactions and increases the likelihood of panic selling. Investors who maintained discipline often did so by deliberately disconnecting during the worst volatility.

Learning from Behavioral Mistakes

Every investor makes behavioral mistakes—the key is learning from them. Keeping an investment journal that documents not just what you decided but why you decided it, and how you felt at the time, creates invaluable feedback for improving future decisions.

Reviewing this journal during calm periods reveals behavioral patterns you can address proactively. Perhaps you consistently sell winners too early or hold losers too long. Perhaps fear consistently causes you to miss buying opportunities. Identifying these patterns allows you to design specific interventions addressing your unique behavioral tendencies.

🌍 Behavioral Economics and Global Market Dynamics

Behavioral patterns aren’t limited to individual investors—they manifest at institutional and even market-wide levels, creating opportunities for those who recognize them.

Cross-Cultural Behavioral Differences

Different cultures exhibit different behavioral patterns in financial markets. Asian markets often show different herd behavior patterns than Western markets. Emerging markets may exhibit more extreme reactions to news than developed markets. Understanding these cultural differences provides advantages for global investors.

These variations create arbitrage opportunities. When a particular market overreacts to news based on cultural behavioral patterns, investors aware of these dynamics can position themselves accordingly, knowing the overreaction will eventually correct.

🚀 The Future of Behavioral Economics in Finance

As artificial intelligence and big data become increasingly prevalent in finance, behavioral economics grows more rather than less important. Machines may execute trades, but humans still make the fundamental allocation decisions that drive markets.

The proliferation of information creates new behavioral challenges. Social media amplifies herd mentality and recency bias, spreading market narratives at unprecedented speed. Investors must develop new behavioral skills to navigate this environment, filtering signal from noise more effectively than ever before.

Paradoxically, as markets become more efficient through technology, behavioral inefficiencies may represent the primary remaining source of alpha. Investors who master their own psychology while recognizing behavioral patterns in others will possess increasingly valuable skills as quantitative factors become commoditized.

⚖️ Balancing Rationality and Behavioral Awareness

The goal isn’t to become purely rational—that’s impossible and perhaps even undesirable. Emotions provide valuable information and drive necessary action. The goal is awareness: recognizing when emotions are useful guides versus when they’re leading you astray.

Successful navigation of turbulent markets requires integrating behavioral awareness with fundamental analysis and risk management. Neither pure quantitative analysis nor pure behavioral understanding suffices alone. The most sophisticated approach recognizes that markets are simultaneously driven by fundamentals and psychology, with each influencing the other in complex feedback loops.

During uncertain times, this integrated approach provides both tactical advantages and psychological resilience. You can capitalize on others’ behavioral mistakes while avoiding your own. You can maintain discipline when markets test your conviction. Most importantly, you can position yourself not just to survive turbulence but to emerge stronger and more prosperous.

The power of behavioral economics in uncertain markets ultimately lies not in prediction but in preparation. By understanding the psychological forces that drive market behavior, you can prepare strategies, systems, and mindsets that allow you to act decisively when others are paralyzed by emotion. In volatile markets, this behavioral edge often matters more than analytical sophistication or information advantages, transforming uncertainty from threat into opportunity for those prepared to seize it.